Submitted by Editor on Mon, 01/04/2019 - 10:01

Northern LGPS’s response to the latest pooling guidance featured in The Times on Monday 1 April 2019.

Submitted by Editor on Thu, 28/03/2019 - 10:25

The Northern LGPS has responded to the informal consultation for the 'Draft Statutory Guidance on Asset Pooling'.

Submitted by Editor on Tue, 26/02/2019 - 10:33

Over seventy people attended the inaugural Northern LGPS Stewardship Day at Aintree Racecourse in January.

Submitted by Editor on Thu, 31/01/2019 - 15:55

Northern LGPS has published its Responsible Investment Policy.

Submitted by Editor on Fri, 18/01/2019 - 15:55

Councillor Paul Doughty has been named chairman of the Northern Local Government Pension Scheme (LGPS) pool, replacing Ian Greenwood who died in November.

Submitted by Editor on Wed, 14/11/2018 - 16:57

The Northern Pool has been shocked and greatly saddened by the sudden death of our Chairman Ian Greenwood. Northern Pool Vice-Chairs Councillors Brenda Warrington and Paul Doughty have issued a joint statement paying tribute to Ian's contribution.

The Northern Pool has been shocked and greatly saddened by the sudden death of our Chairman Ian Greenwood. Northern Pool Vice-Chairs Councillors Brenda Warrington and Paul Doughty have issued a joint statement paying tribute to Ian's contribution.

Submitted by Editor on Wed, 07/11/2018 - 11:20

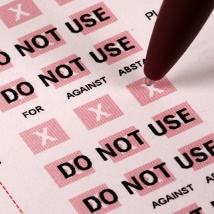

The Northern Pool publically discloses its proxy voting at AGMs and EGMs of the companies in the Pool's portfolios. The Pool has adopted the PIRC Shareowner Voting Guidelines. PIRC considers the a number of factors in presenting voting recommendations to its client.

The Northern Pool publically discloses its proxy voting at AGMs and EGMs of the companies in the Pool's portfolios. The Pool has adopted the PIRC Shareowner Voting Guidelines. PIRC considers the a number of factors in presenting voting recommendations to its client.

Submitted by Editor on Mon, 08/10/2018 - 14:18

The local authority pension fund partners of GLIL Infrastructure LLP (GLIL) have pledged a further £550m to the platform, bringing the total they have invested and committed to more than £1.8bn. GLIL targets core infrastructure projects, mainly in the UK, and is run by Northern Pool and Local Pensions Partnership (LPP), which manages the assets of Berkshire, Lancashire and London Pensions Fund Authority.

The local authority pension fund partners of GLIL Infrastructure LLP (GLIL) have pledged a further £550m to the platform, bringing the total they have invested and committed to more than £1.8bn. GLIL targets core infrastructure projects, mainly in the UK, and is run by Northern Pool and Local Pensions Partnership (LPP), which manages the assets of Berkshire, Lancashire and London Pensions Fund Authority.

Submitted by Editor on Thu, 05/07/2018 - 10:18

The £1.275 billion GLIL Infrastructure fund (GLIL) today announces it has invested £106 million into Semperian PPP Investment Partners Holdings Limited (Semperian), the social infrastructure company, acquiring a minority shareholding. The investment gives GLIL’s investors access to Semperian’s large and diversified portfolio of mature, operating infrastructure assets within the social infrastructure sector.

The £1.275 billion GLIL Infrastructure fund (GLIL) today announces it has invested £106 million into Semperian PPP Investment Partners Holdings Limited (Semperian), the social infrastructure company, acquiring a minority shareholding. The investment gives GLIL’s investors access to Semperian’s large and diversified portfolio of mature, operating infrastructure assets within the social infrastructure sector.

Submitted by Editor on Tue, 24/04/2018 - 15:03

The £1.275 billion GLIL Infrastructure platform (GLIL) is looking to bring the benefits of its leading infrastructure capabilities to a wider range of investment partners, following strong growth in the three years since its launch. The platform has also been re-launched under a regulated structure.

The £1.275 billion GLIL Infrastructure platform (GLIL) is looking to bring the benefits of its leading infrastructure capabilities to a wider range of investment partners, following strong growth in the three years since its launch. The platform has also been re-launched under a regulated structure.

Pages